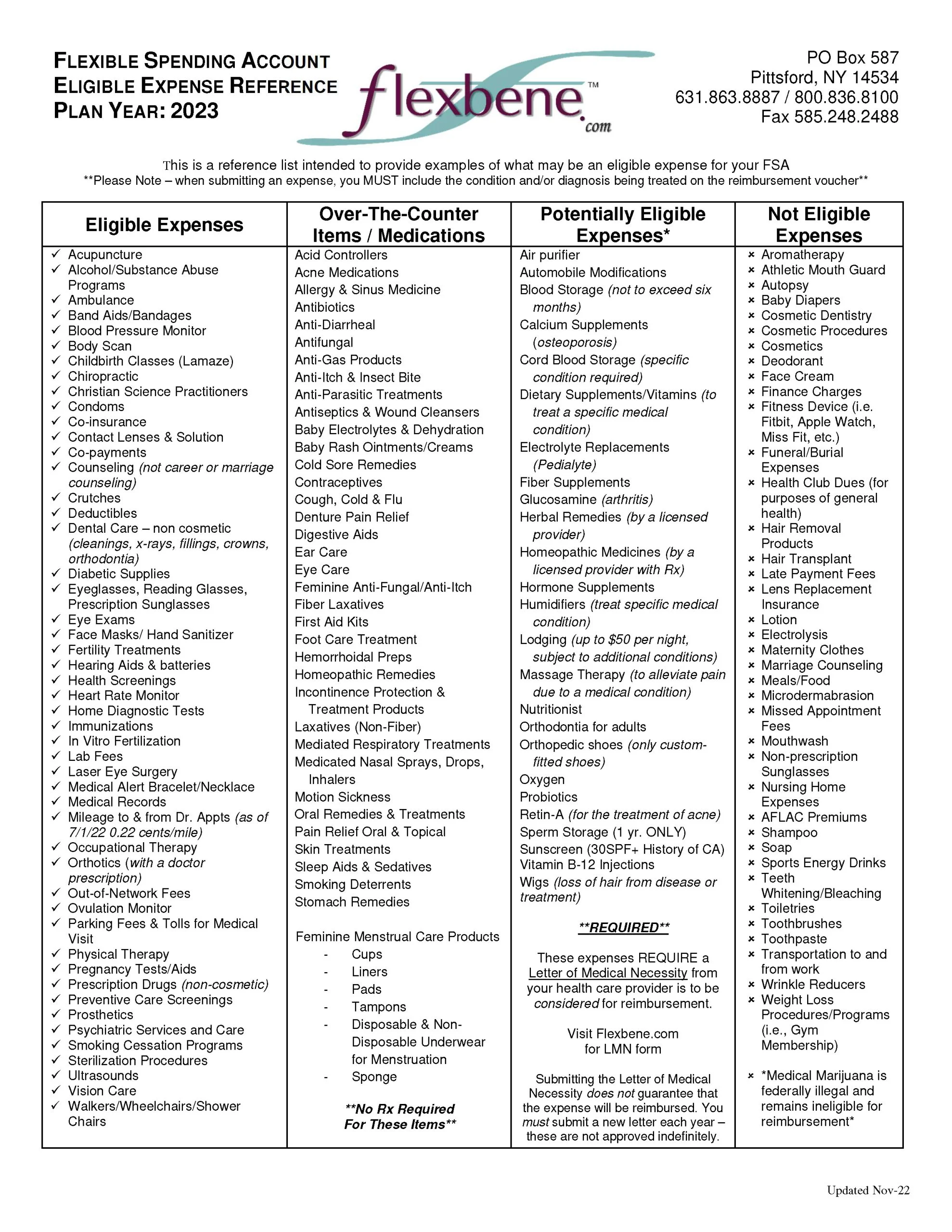

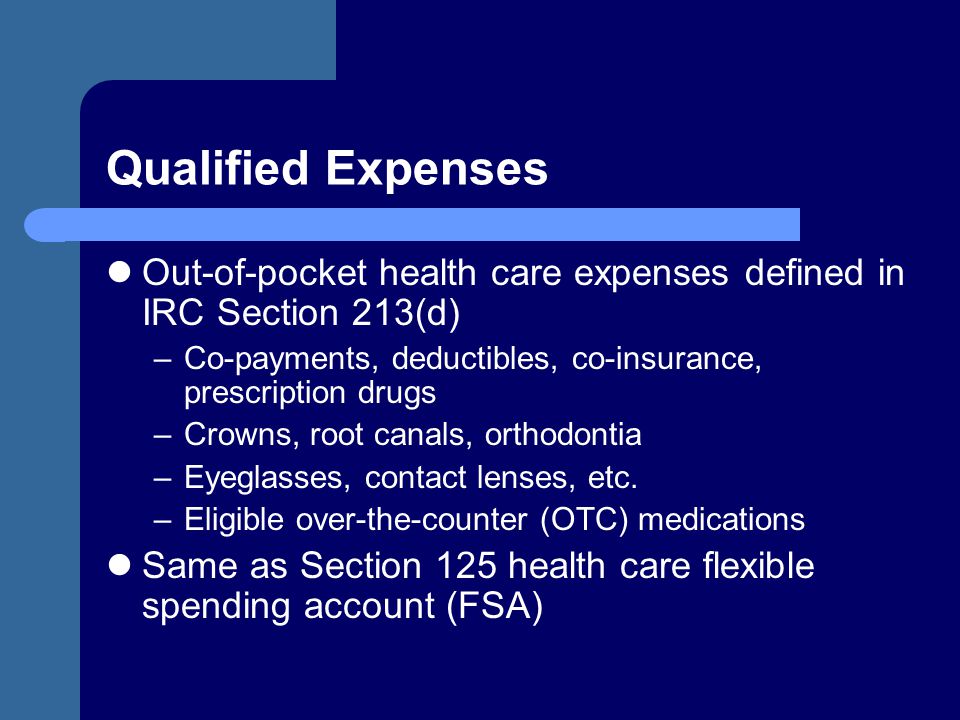

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

$ 111.00

-

By A Mystery Man Writer

-

-

4.8(521)

Product Description

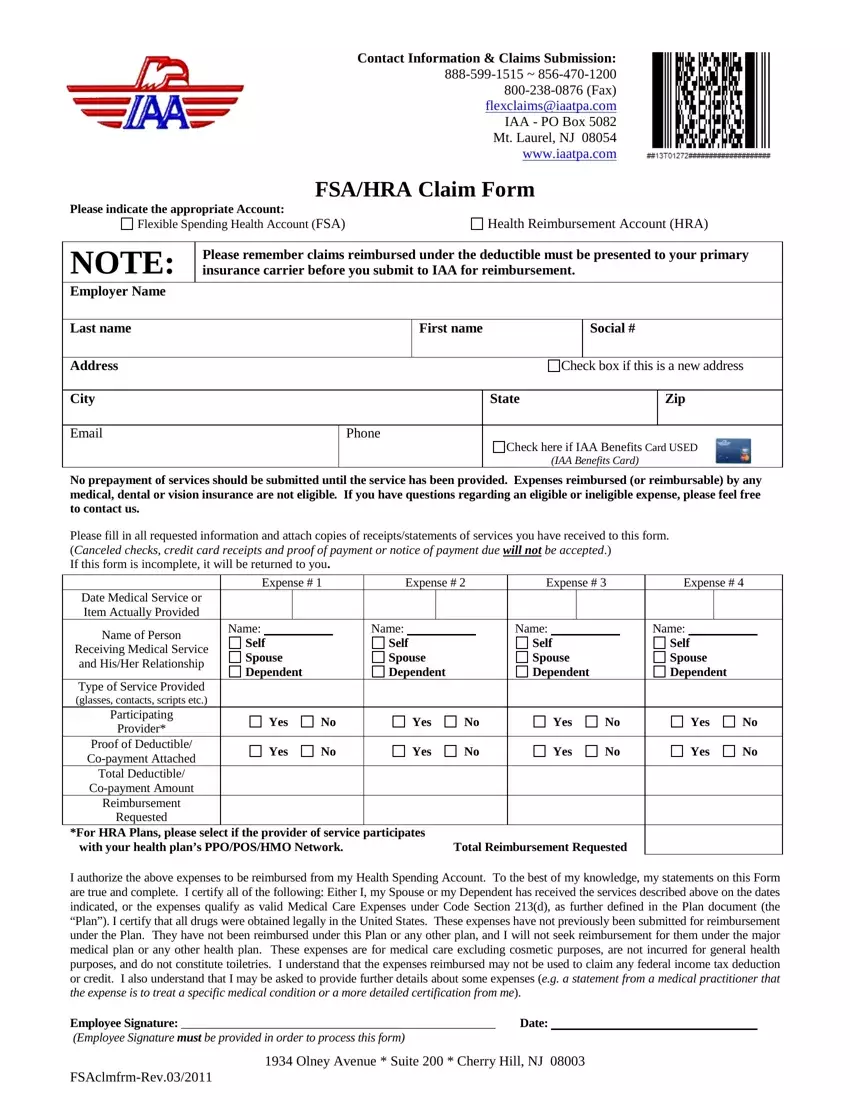

Iaa Fsa Hra Claim Form ≡ Fill Out Printable PDF Forms Online

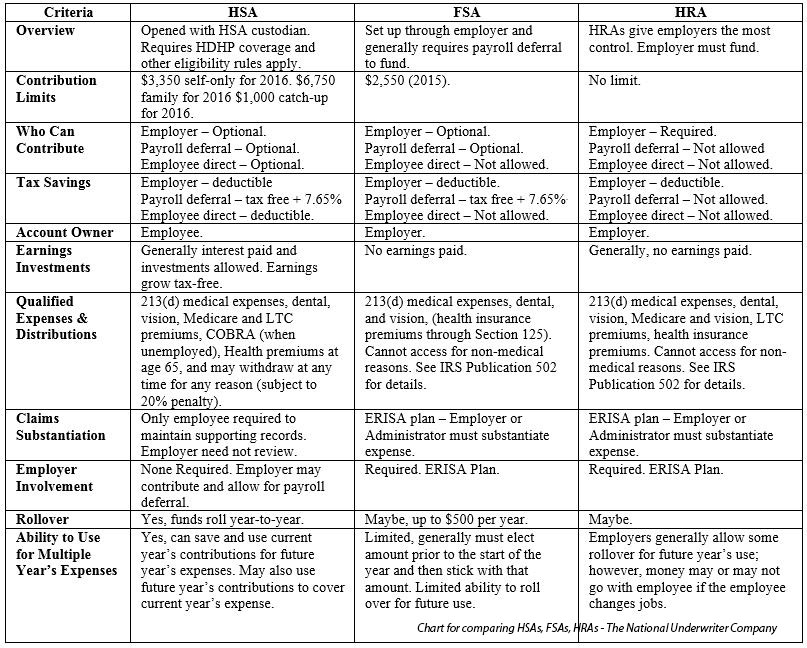

Guide to Offering Health Spending Benefits for Mental Health

FSA Archives - Admin America

9 Top FAQs about HSAs, FSAs, and HRAs

Much-Anticipated Guidance Didn't Deliver New Information

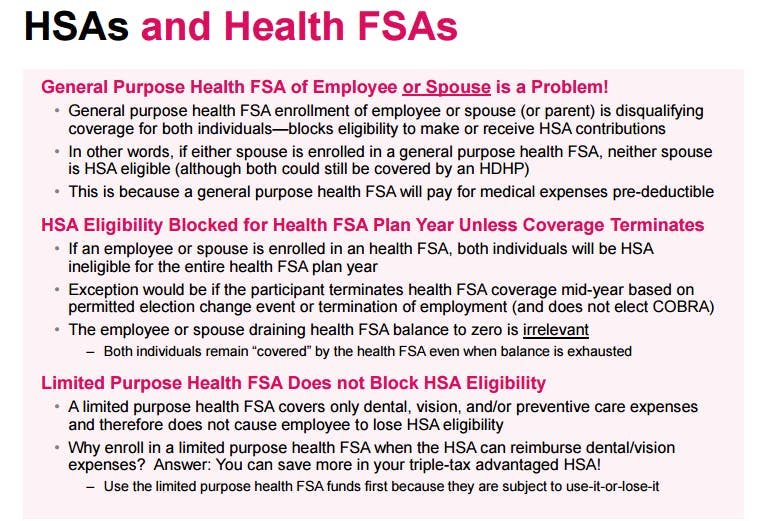

HSA Interaction with Health FSA

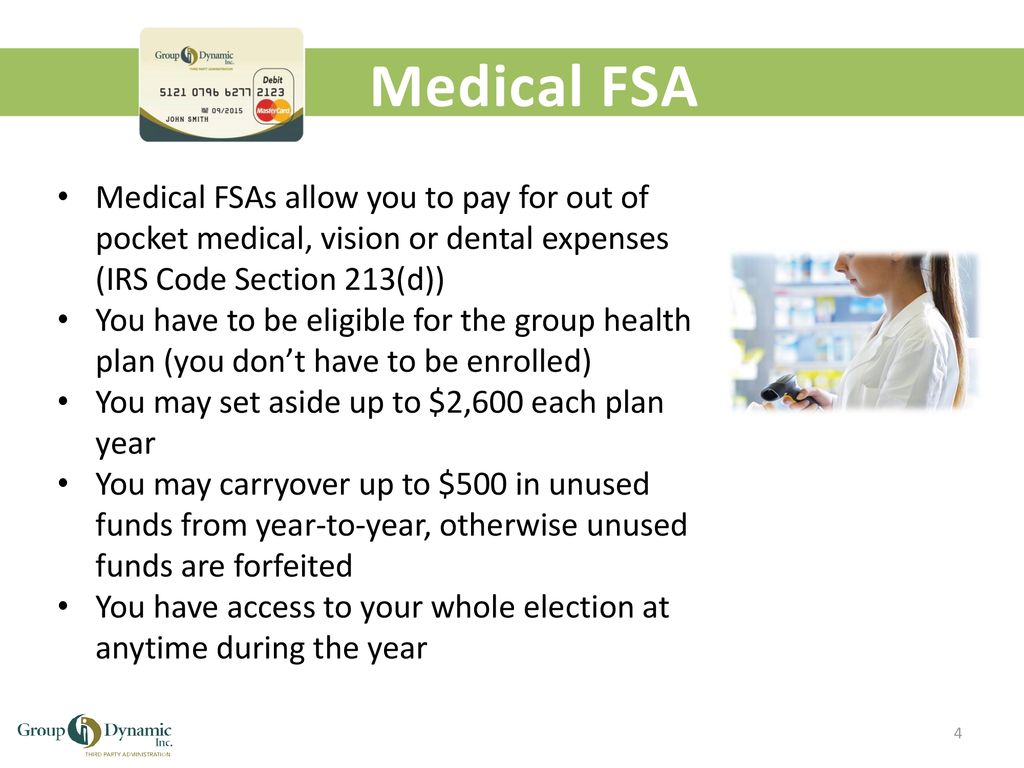

Flexible Spending Accounts - ppt download

IRS Guidance on How Health FSA Carryover Affects Eligibility for

VEBA MEP A tax-free health reimbursement arrangement for

2024 COLAs - Health FSA, Qualified Transportation and More